Propeller raised an additional $15.35M: Here’s what the recent funding means for worksites

More funding, more innovation, new map-based workflows for construction, quarries, mines, and landfills

Today, we announced that we’ve raised another USD 15.35M (AUD 22.8M) in funding from new and existing investors.

Like others before, the recent funding round was led by high-quality investors — Blackbird and Costanoa, two long-time Propeller supporters, joined by several exciting additions, Aware Super, Canva founder Cliff Obrecht, and Aconex founder Leigh Jasper’s fund Saniel.

“Funding is good for Propeller, but how’s this a win for worksites?”

Propeller is over 200 employees strong and powering more than 15,000 worksites each month. This year, we’ve launched a mobile app to bring maps to the field, expanded our presence in Europe, and have continued to improve our accuracy and processing turnaround time. With this additional funding, we will further invest in our products and team—and ultimately, better support our customers.

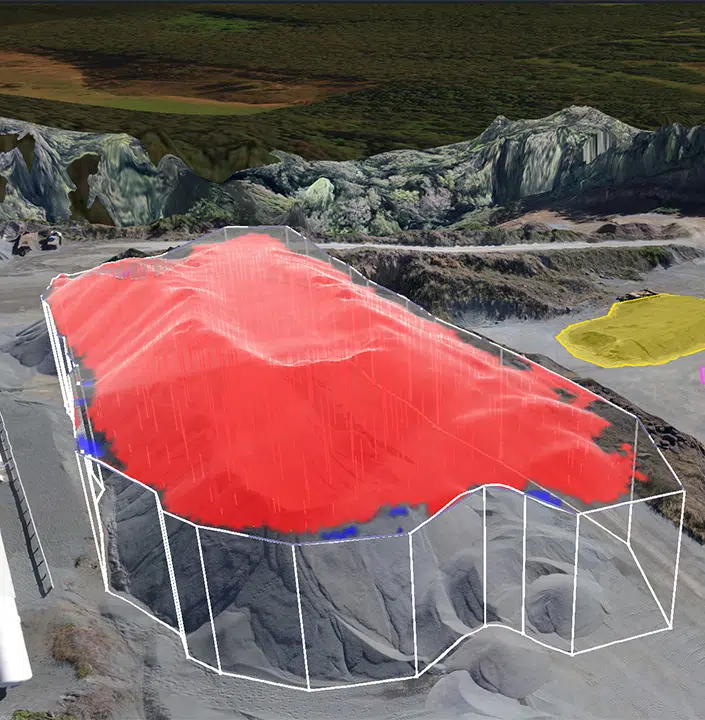

While our core product is drone mapping software, there’s a new (smarter) worksite collaboration workflow that emerges when you combine survey data and maps. The recent funding will help us bring more insights to the map to create a digital meeting ground for project teams — a category of technology we’re dubbing smart surveys.

Maps are universally understood, making them the ideal home for all the data points needed to measure and manage the many variables related to sitework. Our next product, DirtMate, represents just one of the numerous ways we’re evolving the map to bring efficiency gains to worksites.

Our investors at Aware Super said it best; “Historically, the construction industry hasn’t had the data or tools available to effectively track their projects, often resulting in delays and cost overruns. Propeller makes data capture and survey analysis available to everyone to support the delivery of effective project management and better outcomes. From our very first meeting, we were impressed by the team’s execution and the vision they’ve laid out to become the clear leader to digitize the construction industry.”

From here, we’ll continue to grow sensibly as a business. Aware Super went on to comment, “In an environment where most VC-backed companies have been forced to take significant actions to preserve cash and defer funding rounds, Propeller stands out for its high growth with remarkable capital efficiency. The company’s ability to raise a very strong round of funding in a difficult market is a testament to this.” Moving forward, you can expect more sustainable investments that move the needle for everyone in Propeller’s orbit.