How Does Better Data Capture Make the Role of the Surveyor on Site More Important Than Ever?

There’s been speculation that drones and other semi-autonomous surveying solutions are going to put surveyors out of the job. But with survey data becoming more affordable and easy to get, the need for surveyors is actually increasing.

“There’s more work for surveyors to do in a world where there’s, essentially, infinite survey data,” notes Francis Vierboom, Propeller’s co-founder.

They simply won’t be preoccupied with capturing data anymore. One of the new ways making survey data easier to capture is drone technology.

Drone surveying allows surveyors to drastically reduce the time they spend out in the elements, walking a construction site. They can spend the bulk of their time on explaining, interpreting, and analyzing that information instead.

“Surveyors who have the expertise to understand things like complex spatial problems are going to be even more in-demand when there’s so much to gain from having so much information,” said Vierboom.

Construction is beginning to harness the power of drones

When you look at the history of surveying on construction sites, you see a world where survey data was expensive and thus rare. Today you can capture survey data cheaply and easily.

When looking at early adoption in the industry and what this new tool was used for, imagery comes first.

“Drones were a really useful way to quickly and cheaply create a visual of your site. For many years, people paid thousands of dollars to capture their site in order to have a comprehensive view of what was happening,” Vierboom added. The drone’s more advanced uses came with time and trust.

How did early drone adoption lead to better construction site visuals?

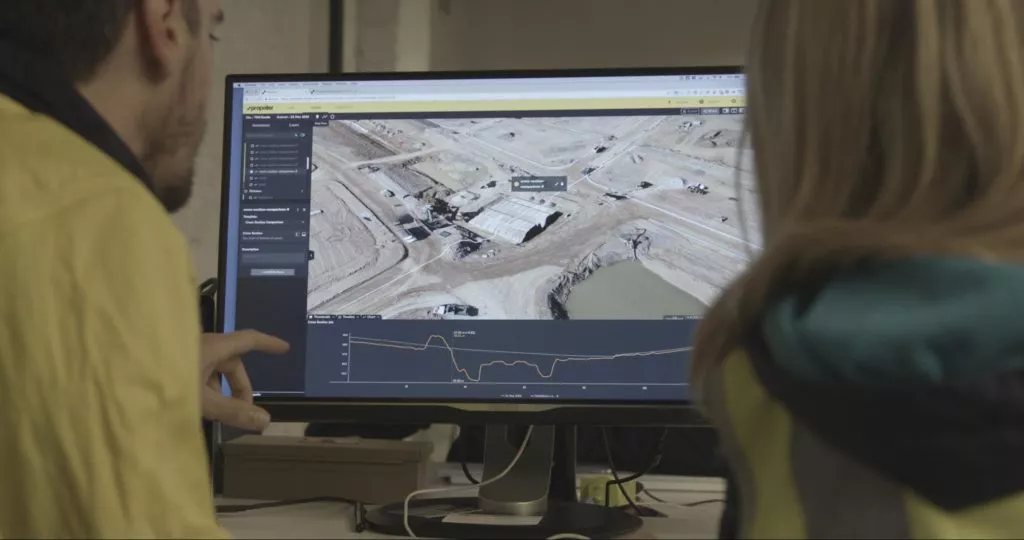

At almost every site office, there’s a map on the wall of the whole project. These straightforward visuals are important for everyone—from site orientation to safety briefings.

“It helps everyone quickly see where things are and how the design relates to what’s happening on the ground today,” said Vierboom.

“And simply making it affordable to capture that visual of what’s happening has been the first and still really important upgrade to what construction teams get out of drone technology.”

But that utility is already changing.

The data used to make maps like these is a source of real insight and analysis. Drones have paved the way to gather accurate quantities more frequently, building a much-needed empirical basis for site reporting, measurements, and budgets.

Survey reporting, progress reporting, and productivity insights are the new phase that accurate drone-captured data is impacting—and what businesses are getting serious about.

“The ability to get real reporting insights from your site as often as you want is going to have a transformational effect on how teams work together on a construction site,” Vierboom noted.

Affordable RTK hardware has changed drone surveying standards

RTK technology has existed for a while, but new drones like DJI’s Phantom 4 RTK mean that tech can be purchased in an off-the-shelf drone.

“This drone’s position is tracked very accurately. We are recording where it goes and comparing that to the base station after the flight. Putting those positions together provides very accurate positions of where photos are captured in flight,” said Propeller Co-founder and CEO Rory San Miguel. “This means each photo becomes like a ground control point.”

There are a few ways to take advantage of RTK technology on a construction site, one of which is Propeller’s unique solution, Propeller PPK, which gives 1/10ft accuracy site-wide.

Why is digitization the first step in closing the productivity gap on site?

According to the McKinsey Global Institute (MGI), “abundant gains are at stake. MGI’s research found that if construction productivity were to catch up with that of the total economy—and it can—the sector’s value added would increase by an estimated $1.6 trillion, adding about two percent to the global economy.”

This presents a huge opportunity and motivation for businesses to digitize and modernize.

And “whenever sufficient information can be quantified, modern statistical methods will outperform an individual or small group of people every time,” according to the Harvard Business Review.

What the construction industry is realizing is that it has many different kinds of data (of which survey data is only one) and a lot of it. So-called “big data” doesn’t erase the need for human insight. These are simply better tools to do the job.

Prepare for skilled labor availability to decrease while costs increase

We predict that construction firms are going to need to seek a different breed of talent for long-term success. McKinsey specifically recommends exploring “talent pools in digital native companies, even those outside the E&C industry; a particular focus should be given to candidates in other industries that have undergone a digital transition.”

This matches a general increase in construction labor costs and a reduction of young people entering the industry. It’s already a strain for those trying to hire for surveyors.

In 2018, labor costs went up by 2–3%, according to Oldcastle Buildings Solutions’ 2018 North American Construction Forecast Report. Additionally, during 2005–2016, the number of young construction workers decreased by a whopping 30%.

So you can expect that as more workers retire, there may be fewer young people to replace them. And to get those who are on the market, companies will need to offer better digital tools.

“The issue of a skilled-labor shortage is one of workload,” noted San Miguel. “The future workforce needs to be doing more with less. So instead of just fixing the hiring problem, companies need to adopt tools to fix the workload problem.”

Want to learn more about surveyors and construction’s digital revolution? Download our 2019 Construction Industry Trends and Predictions report.

You might also like:

How Propeller PPK Revolutionizes Surveying If You Haven’t Used Drones Before

How Trimble Stratus Integrates with Trimble Business Center

Improve Earthwork Estimates with Drone Data